Interest On Late Payment Of Tax Under The GST Regime

Interest must be paid in case of delay in payment of tax under the GST regime. Certain provisions have been drafted for interests to be paid when there is a delay by the taxpayer or by the department.

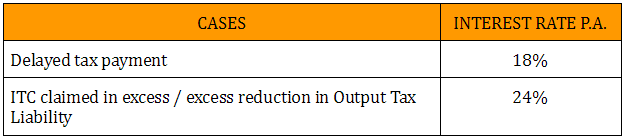

The two cases where a taxpayer is liable to pay interest are:

- Delayed payment of tax

- ITC is claimed in excess or incorrectly. where it was not eligible to be claimed or tax liability is shown less than the actual liability.

INTEREST RATES

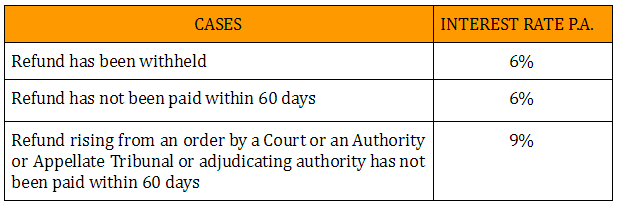

The three cases where the Department is liable to pay interest on delayed payment to a taxpayer are:

The Interest amount to be paid by the department:

- Refund of tax has been withheld from a person on account of an appeal or proceeding but which is later found to be eligible to be paid

- Refund of tax has not been given to a person within 60 days from the date of receipt of an application for refund

- Refund ordered by an adjudicating authority or Appellate Authority or Appellate Tribunal or court has not been paid to a person within 60 days from the date of receipt of an application for refund.

INTEREST RATES

Hence, it is imperative for you as a taxpayer, to avoid instances of interest payment. Default in payment of tax will also have an impact on your compliance rating. Timely and accurate compliance will help you to avoid unnecessary cash outflow and achieve a good compliance score.