Composition Scheme Under The GST Regime

ELIGIBILITY FOR GST COMPOSITION SCHEME:

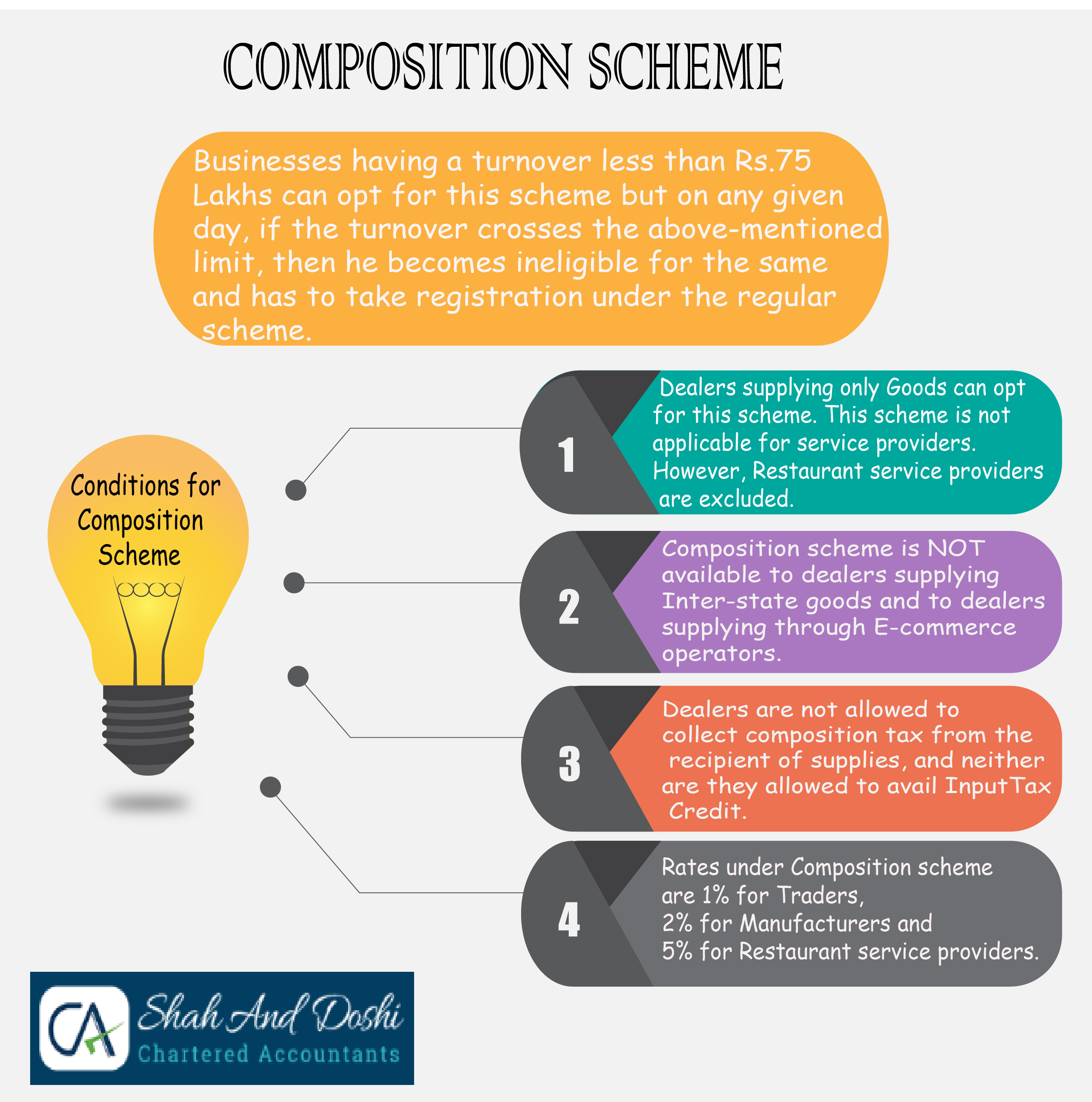

The registration under composition scheme is optional and voluntary. Businesses having a turnover LESS THAN Rs. 1.0 Crore* can opt for this scheme but on any given day, if the turnover crosses the above-mentioned limit, then he becomes ineligible for the same and has to take registration under the regular scheme.

* The threshold limit for opting into the composition scheme is recommended for an increase to Rs. 1.5 crores but yet to be notified.

Following are the certain conditions to be noted before opting for the composition levy.

They are as follows:

- Dealers supplying Goods can only opt for this scheme. This scheme is not applicable to service providers. However, Restaurant service providers can opt for this scheme.

- There should not be any interstate supply of goods i.e. businesses having the only intrastate supply of goods are eligible.

- Any dealer who is supplying goods through electronic commerce operator will be barred from being registered under the composition scheme.

For example: If a person sells its products through Flipkart or Amazon which is an Electronic Commerce Operator then that person cannot opt for the composition scheme.

- GST Composition scheme is levied for all business verticals with the same PAN, a taxable person will not have the option to select the composition scheme for one, opt to pay taxes for other.

- Dealers are not allowed to collect composition tax from the recipient of supplies, and neither are they allowed to avail Input Tax Credit.

- Dealers who collect Tax at source u/s 56.

BENEFITS UNDER GST COMPOSITION SCHEME–

1. LESS COMPLIANCE:

In the composition scheme, only a quarterly return will be uploaded under GSTR-4 by:

- 1st quarter – 18th July

- 2nd quarter – 18th Oct.

- 3rd quarter -18th Jan.

- 4th quarter – 18th April

This will ease the compliance burden for SMEs, and they can focus more on their business rather than getting occupied in the compliance procedures.

2. REDUCED TAX LIABILITY:

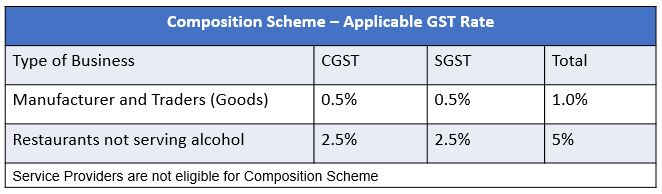

The advantage of being registered with the composition scheme is the rate structure. Registered taxpayer, who is registered under the GST Composite Scheme, will pay tax at a rate, not more than 0.5% for the manufacturer, 2.5% for the restaurant sector.

As per notification dated 01.01.2018, turnover in case of traders has been defined as ‘ Turnover of taxable supplies of goods’.

3. HIGH LIQUIDITY:

For normal taxpayers, most of their Working Capital will be blocked as Input Tax Credit because he can avail the input only if his supplier has filed the return. The supplier has to pay tax at standard rate and credit of the input will only be availed when his supplier files the return.

In composition levy, dealer need not worry about his supplier filing return as he cannot take credit and will pay tax at a nominal rate.

4. TRANSITIONAL PROVISIONS:

Taxpayers who have opted for the GST Composition Scheme & have transited to GST will be allowed to take Credit of Input, semi-finished & finished goods on the day immediately preceding the date from which they opt to be taxed as a regular taxpayer.

The inputs can only be availed subject to few conditions such as;

- Those inputs or goods are meant for making taxable outward supplies under the GST provisions.

- The taxpayer claiming Input credit on goods, those goods should be eligible for such credit under the GST regime.

- The taxpayer must have a valid legal document of input tax credit i.e. he must possess an invoice evident of taxes or duties that have been paid.

Those invoices or documents should not be older than 12 months before the appointed date.

When a taxpayer is shifting from a normal scheme to composition scheme, the taxpayer has to pay an amount which shall be equal to the credit of input tax in respect to those inputs which are held as stock on the immediately preceding date from the date of such switchover.

Any balance which is left in Input Tax Credit account after such payment, then that balance will lapse and not usable.