Input Tax Credit On Job Work

The principal is eligible for ITC on the inputs and capital goods sent for job work.

WHEN INPUTS OR CAPITAL GOODS ARE SENT FOR JOB WORK

No tax is applicable when Inputs or Capital Goods are sent for Job work. The Principal must Issue a Delivery Challan while removing the goods for job work.

WHEN INPUTS OR CAPITAL GOODS SENT FOR JOB WORK ARE BROUGHT BACK WITHIN 1 YEAR OR 3 YEARS, RESPECTIVELY

-No Tax is applicable.

WHEN INPUTS OR CAPITAL GOODS SENT FOR JOB WORK ARE SUPPLIED FROM THE JOB WORKER’S PLACE WITHIN 1 YEAR OR 3 YEARS RESPECTIVELY

When inputs or capital goods sent for job work are supplied from the job worker’s place of business within 1 year or 3 years respectively, TAX IS APPLICABLE if the supply is within India.

If the supply is for export, no tax is applicable.

For supplying inputs or capital goods from the job worker’s place of business, the principal has to declare the job worker’s place of business as his additional place of business, unless-

- The job worker is registered OR

- The supply is of notified goods

When goods are supplied from the job worker’s place of business, even if the job worker is registered, the supply will be treated as supply by the Principal and the value of the goods will not be included in the job worker’s aggregate turnover.

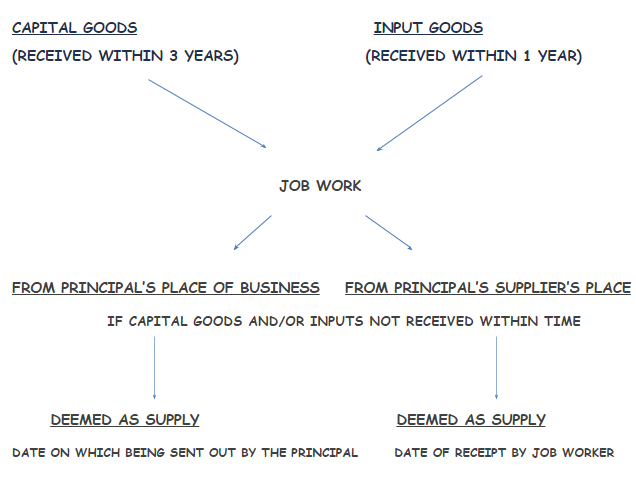

WHEN INPUTS OR CAPITAL GOODS SENT FOR JOB WORK ARE NOT BROUGHT BACK OR SUPPLIED FROM THE JOB WORKER’S PLACE WITHIN 1 YEAR OR 3 YEARS RESPECTIVELY

When inputs sent for job work are not brought back or supplied from the job worker’s place of business within 1 year of their being sent for job work, or if capital goods sent for job work are not brought back or supplied from the job worker’s place of business within 3 years, they will be considered to have been supplied by the principal to the job worker on the day they were sent out. Hence, the Principal will be liable to pay tax on the supply, along with the interest due.

The inputs or capital goods can be sent to the job worker without first bringing them to the principal’s place of business. In this case, the period of 1 year and 3 years respectively, will be counted from the date when the job worker receives the inputs or capital goods.

PROCESSING CHARGES CHARGED BY JOB WORKER

-GST is applicable to processing charges charged by the job worker.

-No tax is applicable on moulds and dies, jigs and fixtures or tools sent to a job worker for job work.

To Read about Compliance Procedures & Transition provision for Job work under GST, please CLICK HERE