Accounts & Records To Be Maintained Under GST

1. ACCOUNTS & RECORDS

Accounts & Records maintained by an Organisation are a crucial and important part of the day to day business. They are relied upon at the time of financial reporting, proposals, audits, assessments, etc. The current GST laws prescribe the manner in which the books of accounts and the related records have to be prepared and preserved.

The number of accounts to be maintained is reduced under the GST regime; since all the indirect taxes will be subsumed into GST, the greatest advantage a trader will have is that he can set off his input tax on service with his output tax on the sale.

Every registered taxable person must keep & maintain at his Principal Place of Business, as mentioned in the Registration Certificate, the following true & correct account of following;

- Stock Register (including goods lost, stolen, destroyed, free samples etc).

- Register of goods produced or Manufactured

- Input Tax Credit availed.

- Output Tax payable & paid.

- Supplies attracting RCM.

- Inward or outward supply of Goods/services.

- Goods/services imported or exported.

- All other relevant Documents like Invoices, Bill of supply, Credit & Debit Notes, Receipt & Payment Voucher, Refund Voucher, Delivery challan & e-way bills.

- Advances received, paid & adjustments thereto.

- Names & complete address of vendors & customers.

NOTE:

- If more than One Place of Business is mentioned in the Registration Certificate, then accounts relating to the specified place of business must be kept at such concerned places.

- The accounts, records including other particulars can be kept in the electronic form & authenticated by Digital signature (DSC); accounts & records must be maintained separately for each activity including manufacturing, trading & provision of services, etc.

- Every registered dealer, other than a person paying tax under section 10, the composition of GST levy, shall maintain accounts of stock w.r.t. each commodity received & supplied by him, & such an account will, therefore, contain particulars of the opening balance, receipt, supply, goods lost, stolen, destroyed, written off or disposed of & balance of stock including raw materials, finished goods, scrap & wastage thereof.

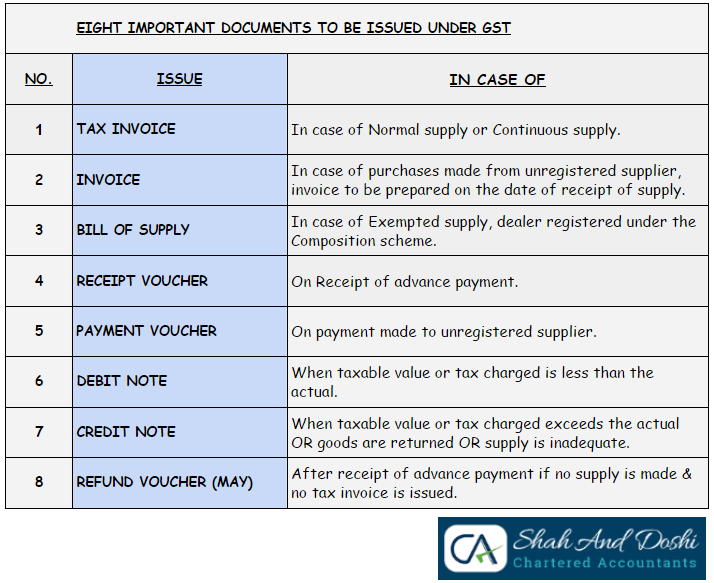

2. Below are the important documents that must be issued and maintained by the Registered dealers;

The formats & contents of each of the above items shall be shared with you in our next blog.

3. PERIOD FOR RETENTION

The period, for which the said books of accounts and other records must be maintained by every registered taxable person is required to keep & maintain accounts & other records are until the expiry of 60 months from the last date of filing of Annual Return for the pertaining year.