The Difference Between CGST, SGST & IGST!

The Centre and the States both have been designated the powers to levy and collect taxes and as per the Constitution, they have different responsibilities to perform.

The dual system of GST will, therefore, be keeping with the Constitutional requirement of fiscal federalism. The Centre and States will simultaneously levy GST. It will replace all the various central & state level taxes and bring them under one roof to make compliance easier and hassle-free.

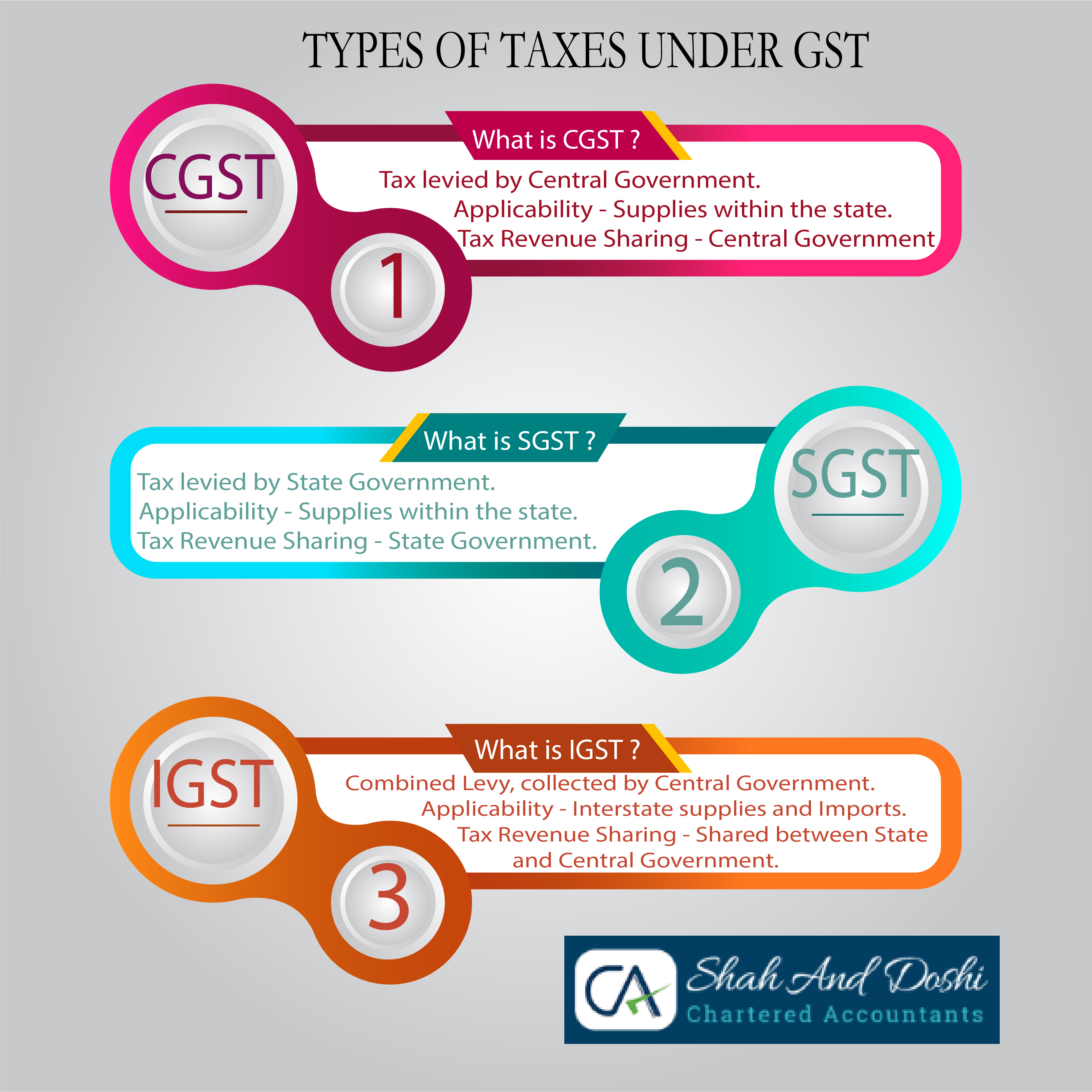

The three main types of GST are CGST, SGST, IGST.

The basic difference between CGST, SGST, IGST has been explained below;

CENTRAL GST (CGST)

Central GST will be levied by the central government on both goods and services to replace the existing taxes like service tax, excise, etc. It only applies to intra-state trade. The dealer can use the benefit of composition scheme up to a turnover of 1.5 crores which has been increased from 1 crore, effective from 1st April 2019.

Dealers can use input tax credit of CGST against CGST or IGST (in that order).

STATE GST (SGST)

State GST will be levied by the state government on both goods and services to replace the existing taxes like sales tax, luxury tax, entry tax, etc. It only applies to intra-state trade. The dealer can use the benefit of composition scheme up to a turnover of 1.5 crores which has been increased from 1 crore, effective from 1st April 2019.

Dealers can use input tax credit of SGST against SGST or IGST (in that order).

INTEGRATED GST (IGST)

Integrated GST will be levied by the central government in case of inter-state supplies and imports, applicable to both goods and services. IGST is designed to enable a seamless flow of input tax credit from one state to another. Composition scheme is not applicable in the course of interstate supply.

Dealers can use input tax credit of IGST against IGST, CGST, or SGST. (in that order)

From the following example you will understand the difference better;

Registered dealer ‘A’ in Maharashtra sells goods to his consumer ‘B’ in Maharashtra worth Rs. 20,000. This is known as an intra-state trade, the GST rate being 18% comprising of CGST rate of 9% and SGST rate of 9%, in this case, A collects Rs. 3,600 and Rs. 1,800 goes to the central government and Rs. 1800 goes to the Maharashtra government.

Now, if dealer ‘A’ in Maharashtra sells goods to another dealer ‘C’ in Goa worth Rs. 1,00,000. This is known as an inter-state trade, the GST rate being 18% comprising of IGST, in this case, dealer A has to charge Rs. 18,000 as IGST, then this IGST goes to the Centre.

EXEMPTION LIMIT

GST registration is mandatory to all dealers with a turnover limit which has been doubled to Rs. 40 lakh* from Rs. 20 lakh (Rs. 20 lakh from Rs. 10 lakh in North Eastern states) in case they are involved exclusively in intra-state trade which means their supplies and sales are within a single state.

*It will come into effect from 1st April 2019.

In the case of inter-state activities, GST is applicable regardless of the turnover.

Very good information on IGST and SGST To know more information on What is IGST please visit this site https://howtoexportimport.com/What-is-IGST-in-brief–4184.aspx