Bill Of Supply Under The GST Regime

A bill of supply is a document of the transaction and is different from a tax invoice as it will not have any tax amount (as tax cannot be charged in the following cases of a bill of supply).

Bill of supply is issued when:

- a registered person is a supplier of exempted goods or services, OR,

- a registered person has opted to pay GST under the composition scheme.

In either of the above cases, the registered person cannot charge GST to the buyer, and hence, there is no tax amount in the bill.

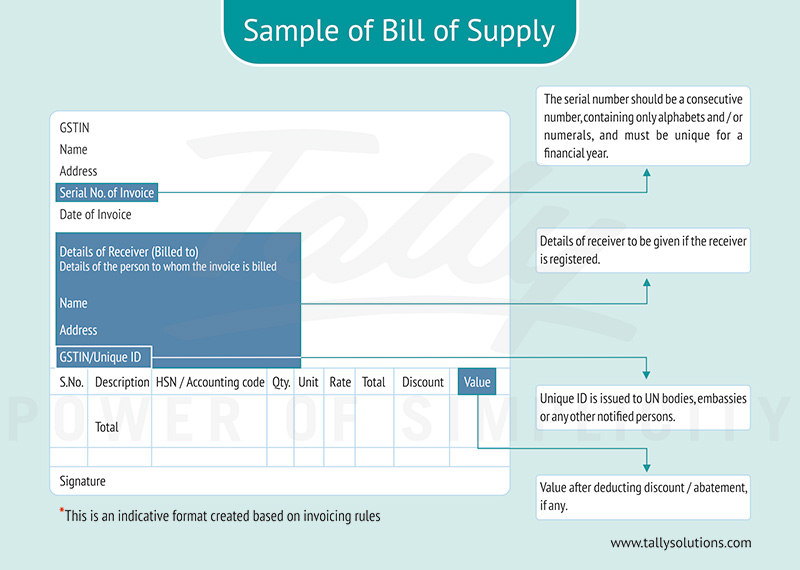

The sample format of a Bill of Supply is below:

Image source: tallysolutions.com

Bill of supply must have the following important elements;

- Name, address and GSTIN and signature of the supplier.

- Date of issue.

- Bill of supply number (must be generated consecutively and each bill of supply will have a unique number for that financial year).

- If the recipient is registered then the name, address, and GSTIN of the recipient.

- HSN Code of goods or the services accounting code (SAC) for services**

- Description & value of goods or services after adjusting the discounts or abatement.

** HSN Code:

- Turnover less than 1.5 crores- HSN code need not be mentioned.

- Turnover between 1.5 to 5 crores can use 2-digit HSN code.

- Turnover above 5 crores must use 4-digit HSN code.

Any Tax Invoice or other documents issued under any other Act w.r.t non-taxable supplies shall be treated as Bill of supply.

For example; GST is not applicable to petroleum products as they are considered to be beyond the scope of GST.

WHEN IS A BILL OF SUPPLY NOT REQUIRED?

The registered person might not issue a bill of supply if the value of supply is less than Rs. 200.

He may also decide not to issue when:

- The recipient is not a registered person AND

- The recipient does not require such bill of supply.

The registered person shall issue a consolidated bill of supply for such supplies at the end of each day in respect of all such supplies.