Matching GSTR-3B With GSTR-1, GSTR-2

Business Entities are now preparing to file their GSTR-1 returns in full swing, after completion of the filing of GSTR-3B returns last month.

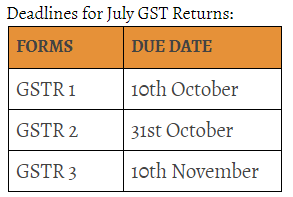

The GST council recently announced it’s decision to extend the due dates for filing GSTR-1, GSTR-2 & GSTR-3 for July is a much-needed relief to the businesses. The revised due dates for filing of GST returns for the month of July are as follows:

GSTR-3B is a summary level Interim return, where the consolidated value of tax liability & eligible Input Tax Credit (ITC) have to be declared, whereas, in the regular normal returns, it is required to declare invoice-wise & rate-wise details. The summary declared in GSTR-3B should match with the details furnished in the regular returns. The filing of GSTR-3B has been extended till the month of December

Matching of GSTR-3B with GSTR-1 & GSTR-2:

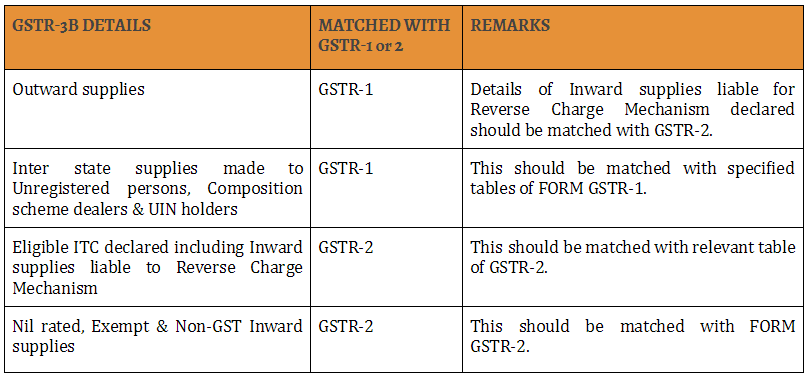

Summary of outward supplies declared in Form GSTR-3B except for Inward Supplies liable for Reverse Charge should ideally match with the invoice-wise details of Outward Supplies declared in Form GSTR-1.

Similarly, ITC details declared in form GSTR-3B including the tax liability on Inward Supplies liable for Reverse Charge should match with GSTR-2.

The details of matching of GSTR-3B with GSTR-1 & GSTR-2 are shown below:

Based on the details of GSTR-1 and GSTR-2, the system would auto-populate the accurate figures of tax amount payable in FORM GSTR-3. The tax already paid through the Electronic cash ledger & Electronic credit ledger while filing GSTR-3B will be auto-captured by the system.

In case there is no difference between the details of Output tax liability & furnished eligible ITC in GSTR-3B & the details furnished in GSTR-1 & GSTR-2, the tax payable amount in Part B of GSTR-3 and tax paid in GSTR-3B will be same. In this case, one can sign & submit Form GSTR-3 without any additional payment of tax.