Everything You Must Know About Tax Invoicing Under GST

An Invoice is required for every form of supply such as transfer, barter, exchange, license, rental, lease or disposal. GST requires a Tax Invoice or Bill of Supply to be issued before or on the occurrence of a certain event or within a prescribed period of time allowing a seamless flow of Input Tax Credits (ITC) across the supply chain. One of the integral pillars of GST is checking the Input Tax Credit (ITC) Claims, for which data of all Invoices must be uploaded and matched. GSTN seeks all registered dealers to file Invoice details in order to do such matching.

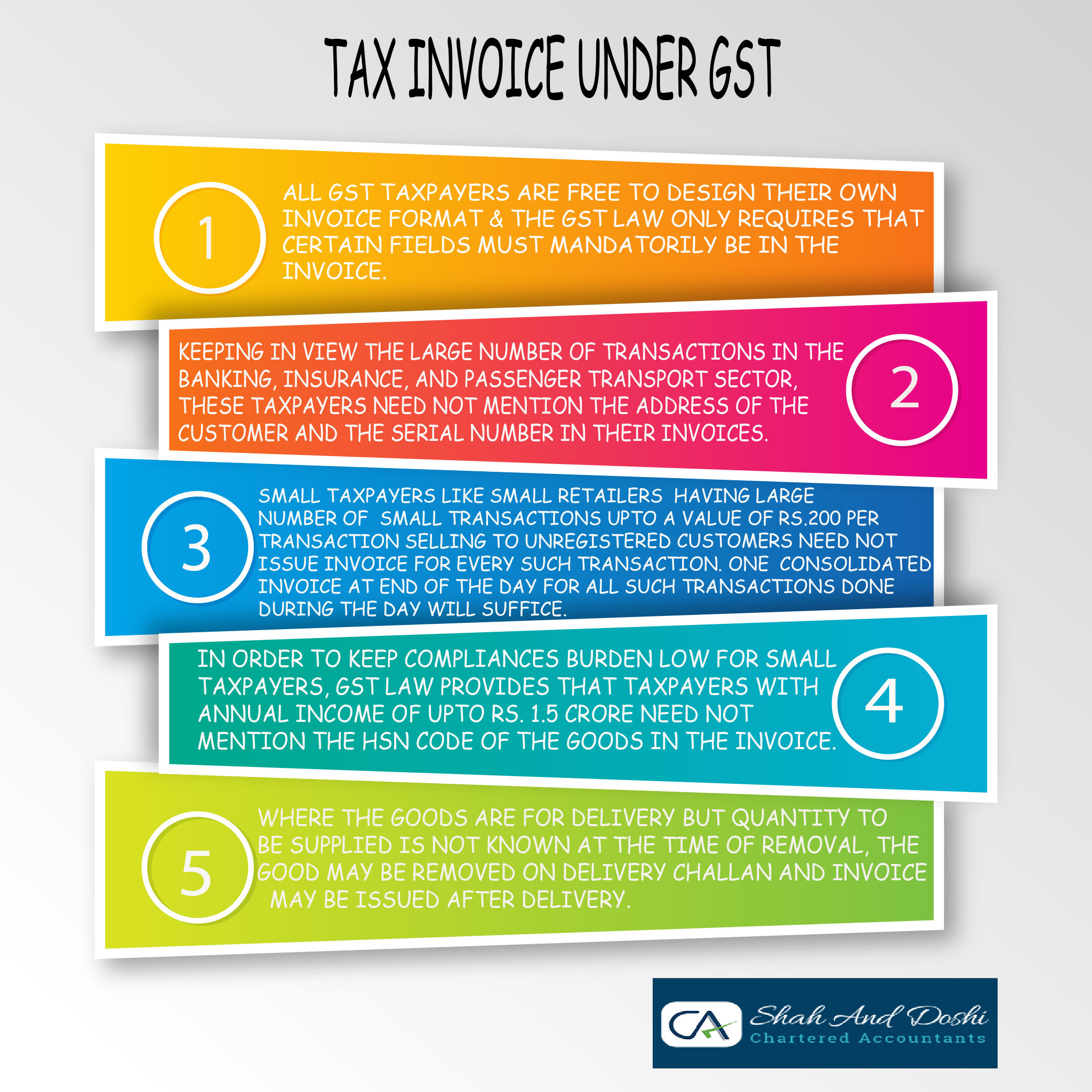

TAX INVOICE

Tax invoice is issued by a registered dealer to the purchaser showing the amount of tax payable which is based on stipulated rules. Once the dealer’s’ issues invoices on the supply of Goods or Services, they must submit the prescribed details of these invoices to relevant tax authorities to enable the customer to avail the Input Tax Credit.

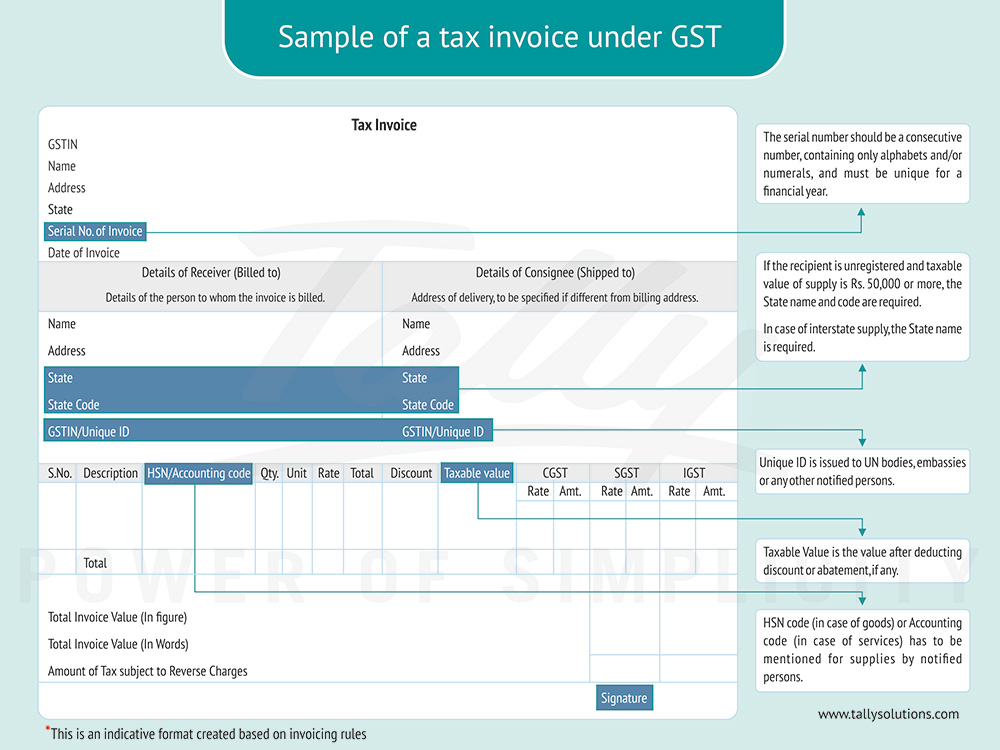

The government has notified rules of invoicing under GST along with a template of invoice (GST INV-01) covering the elements such as supplier’s details, GST tax rates etc that need to be presented.

Image Source: Tally Solutions

To download formats of Tax Invoice, Bill of Supply, Receipt Voucher, Debit Note, Credit Note, etc in Excel; kindly CLICK HERE

TIME LIMIT FOR ISSUE OF TAX INVOICE UNDER GST:

| SUPPLY OF GOODS |

A tax invoice must be issued before or at the time of – i) Removal of goods, where supply involves the movement of goods OR ii) Delivery of goods to the recipient, where supply does not require movement of goods |

| SUPPLY OF SERVICES | The tax invoice must be issued within 30 days from the date of supply of the service. |

*In case a person paying tax on reverse charge receives goods or services from an unregistered supplier, the receiver must issue an invoice on the date of receipt of goods or services.

NUMBER OF COPIES REQUIRED:

For the supply of goods:

- ORIGINAL INVOICE: The original invoice is issued to the receiver, and is marked as ‘Original for recipient’.

- DUPLICATE COPY: The duplicate copy is issued to the transporter, and is marked as ‘Duplicate for Transporter’. This is not required if the supplier has obtained an invoice reference number. The Invoice reference number is given to a supplier when he uploads a tax invoice issued by him in the GST portal. It is valid for 30 days from the date of upload of invoice.

- TRIPLICATE COPY: This copy is retained by the supplier, and is marked as ‘Triplicate for the supplier.

For the supply of services:

- ORIGINAL INVOICE: The original copy of the invoice is to be given to receiver, and is marked as ‘Original for recipient’.

- DUPLICATE COPY: The duplicate copy is for the supplier, and is marked as ‘Duplicate for supplier’.

WHAT DETAILS MUST A TAX INVOICE FOR AN EXPORT CONTAIN?

An export invoice must, in addition to the details required in a tax invoice, contain the following details:

- Export Invoice should mandatorily have the words ‘“Supply meant for export on payment of IGST” or “Supply meant for export under bond without payment of IGST”.

- Name and address of the recipient

- Delivery address

- Number and date of ARE-1 (application for removal of goods for export)