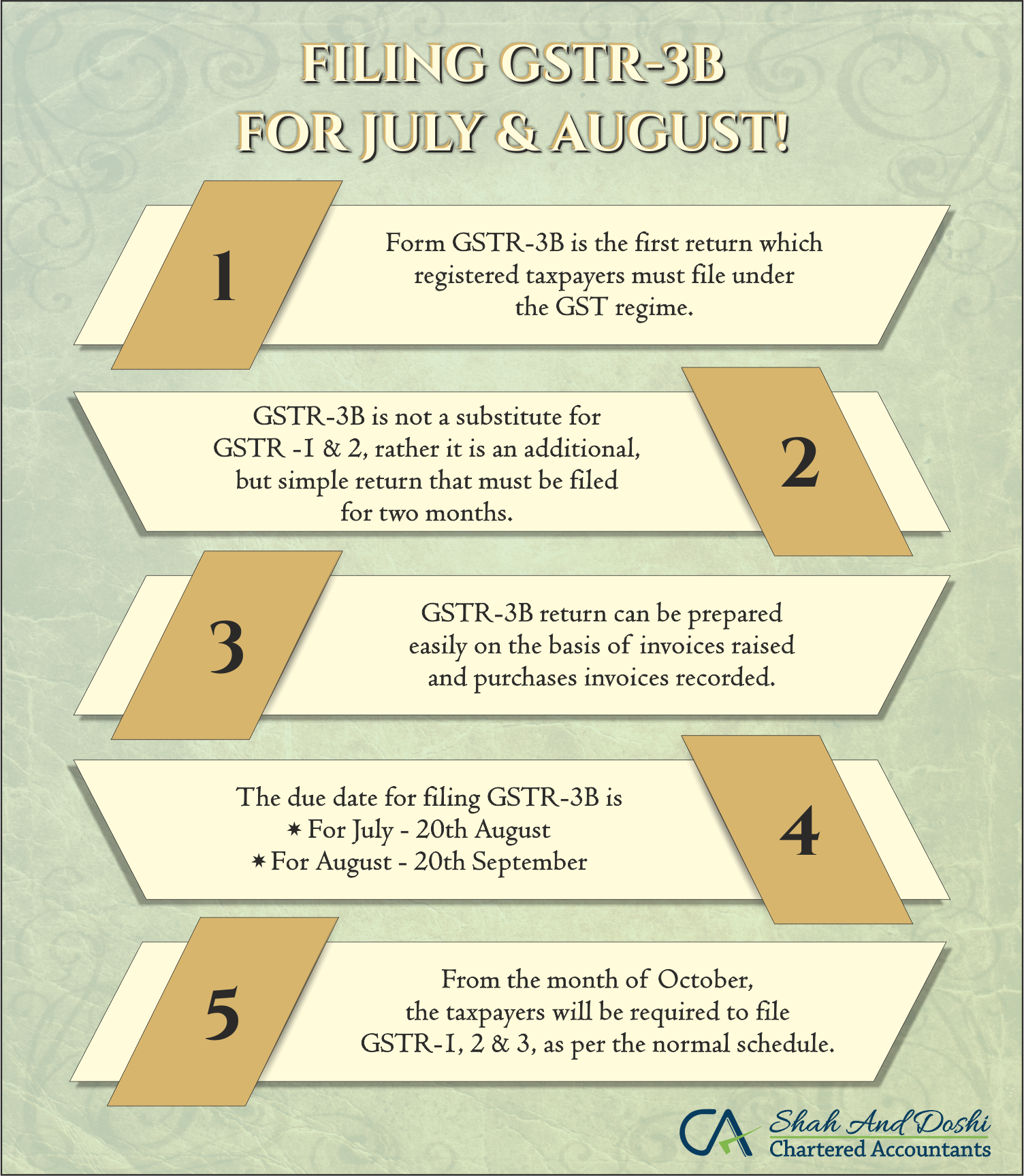

Filing GSTR 3B For The Month Of July & August!

GSTR 3B is a temporary & simpler return that businesses must file in the first two months of GST i.e. in the month of July & August.

Taxpayers need to declare only the summary of outward and inward supplies. However, the invoice-wise details in Form GSTR-1 and Form GSTR-2 for July and August will be filed in September.

Every registered dealer must file three returns every month and one annual return from the month of October.

In total 37 returns must be filed every year. Since filling up these complex forms require a great amount of time and proper procedure, the government has thus, decided to postpone the filing of GSTR 1, 2 & 3 for the months of July and August 2017.

The Government thus introduced GSTR-3B.

*The due date for GSTR 3B has been postponed until 25th August.

IMPORTANT NOTE:

The government gave some relief to taxpayers availing transitional Input tax credit under GST by giving them an extra week until August 28 to file tax returns. They can claim the credit on Central Excise Duty, Service Tax or VAT.

The extended deadline allows taxpayers to file form TRAN 1 by August 28, which is a prerequisite to claim the opening credit. The GST TRAN 1 Form will be available from Aug 21.

- The due date for payment of GST for all assessees is 25th August.

- The due date for Form GSTR 3B for Dealers not availing Transitional Input Tax Credit is 25th August.

- The due date for Form TRAN-1 for Dealers not availing Transitional Input Tax Credit is 30th September.

- The due date for Form GSTR 3B for Dealers availing Transitional Input Tax Credit is 28th August.

- The due date for Form TRAN-1 for Dealers availing Transitional Input Tax Credit is 28th August.

- Interest will be charged on payments made after 25th August.

- The penalty will be charged on returns filed after due dates mentioned in 2. & 4. above.

It is necessary to file GSTR 1, GSTR 2 & GSTR 3 on the revised due dates providing relaxation of 25 additional days for the month of July and 10 additional days for the month of August. GSTR 3B is not a substitute for GSTR 1, 2 & 3.

For September 2017, every taxpayer has to strictly follow the regular provisions of filing GSTR 1, 2 and 3 on 10th, 15th and 20th of the next month i.e. in October respectively.

SECTIONS UNDER FILING GSTR 3B:

- Outward Supplies:

– Details of outward supplies and inward supplies that are liable to reverse the charge.

– Details of inter-State supplies made to unregistered persons, composition dealer & UIN holders.

2. Details of eligible Input Tax Credit

3. Details of exempt, nil-rated and non-GST inward supplies

4. Payment of tax

5. Sections on TDS and TCS have not been notified till date.

HAVE A LOOK AT FORM GSTR-3B HERE