Know Everything About GST E-Way Bill

GST E-Way bill is an electronic bill that is required for the movement of goods where the value of the goods is above Rs. 50,000. The bill can be generated from the GSTN portal and every registered taxpayer must have this e-way bill along with the goods transferred.

There are various rules and regulations issued by the Central Board of Excise & Customs (CBEC) for the handling of the e-way bill.

‘SUPPLY’ IN E-WAY BILL:

supply may be –

- supplied for a consideration i.e. payment in the course of business.

- supplies made for a consideration which may not be in the course of business.

- supplies without consideration.

CBEC has introduced the GST E-WAY BILL for transiting goods worth INR 50,000 or above under the GST regime. The bill requires Online Registration of the consignment thus, maintaining transparency in the system & providing the Tax authorities with a right to inspect anytime if tax evasion is suspected.

The board has issued a draft rule over the Electronic way (e-way) billing which will be requiring registered entities to upload in a format prescribed, where the details of the goods or commodities that are supposed to move in or out of the state are given.

The GSTN will create the e-way bills, valid for a period of 1-20 days that depends on the condition of distance travelling. The draft rules stated that upon the generation of the e-way bill on the common portal, a unique e-way bill number (EBN) will be made available to the supplier, the recipient and the transporter on the common portal.

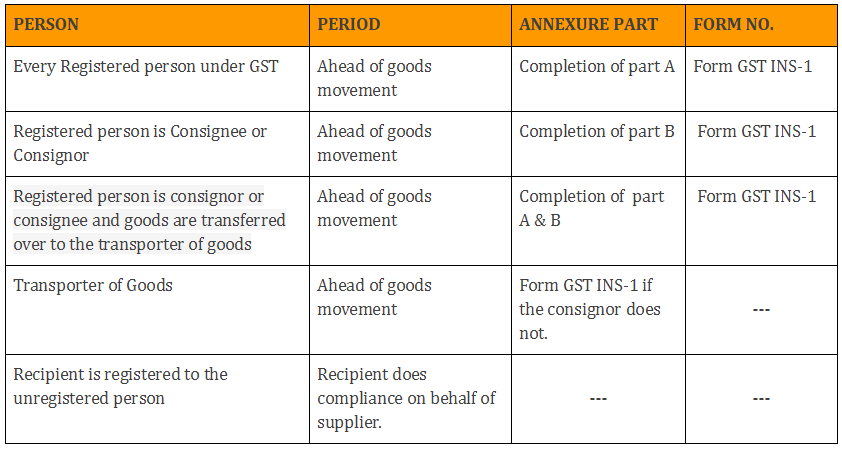

*Unregistered persons or his transporter may also choose to generate an e-way bill, E-way bill can be thus, generated by both registered and unregistered persons. However, where a supply is made by an unregistered person to a registered person, the receiver will have to do all the compliances as if he’s the supplier.

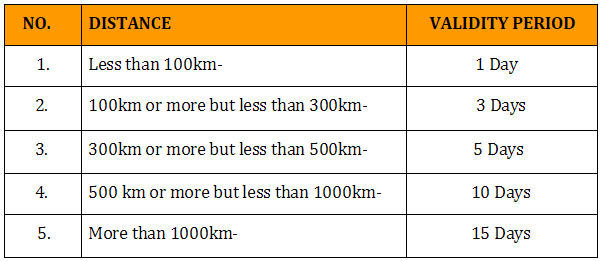

VALIDITY OF E-WAY BILL ACCORDING TO THE DISTANCE:

Validity is calculated from the date & time of generation of E-way Bill –

*Commissioner may extend the period of validity of E-way bill for certain categories of Goods.

Methods of generation of E-way Bill –

The registered person may submit a tax invoice in Form GST INV-1 on the common portal. If a registered person has uploaded the invoice, information in Part A of Form GST INS-1 is auto-populated from GST INV-1. Information in Part A of Form GST INS-01 is for preparing GSTR-1.