All You Need To Know About AOC-4

Every Company registered under the Companies Act, 2013 or the Companies Act, 1956 is required to file their Financial Statements in e-Form AOC-4 including Directors Report along with other relevant attachments (Annual Report) and Annual Return in e-Form MGT-7 within 30 days and 60 days respectively from conclusion of its Annual General Meeting (AGM).

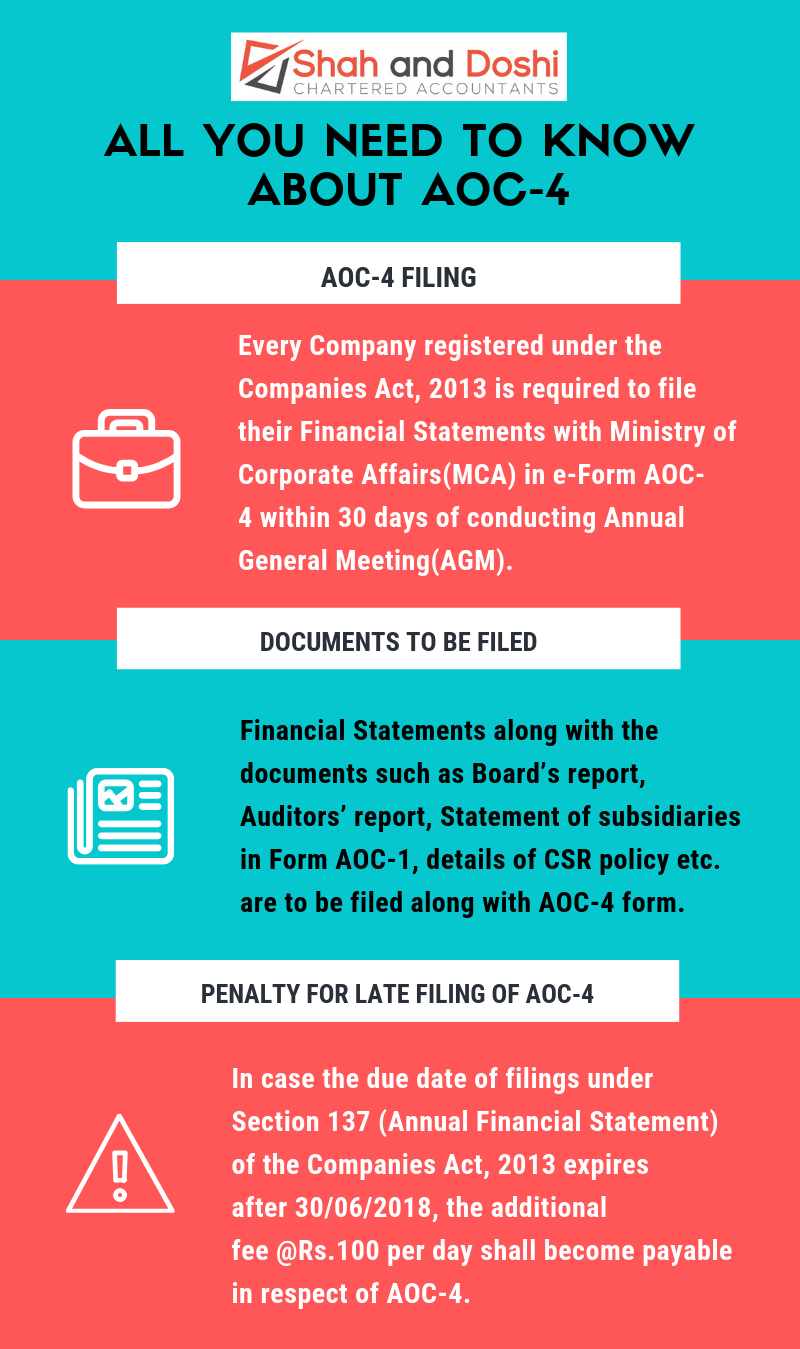

AOC-4 Filing

The financial statements of a company must be filed with the Ministry of Corporate Affairs (MCA) every year. AOC-4 is the MCA form for filing financial statements. Hence, Form AOC-4 is submitted to the MCA for each financial year within 30 days of a company’s Annual General Meeting. The documents such as Board’s report, Auditors’ report, Statement of subsidiaries in Form AOC-1, details of CSR policy etc. are to be filed along with the AOC-4 form. A practising Chartered Accountant or Company Secretary must certify AOC-4.

Documents to be Filed In AOC-4

Financial Statements of a company include Balance Sheet, Profit and Loss Account, Cash Flow statement (if applicable), statement of change in equity (if applicable) and any explanatory notes annexed to the financial statements. Financial statements along with Board Report must be filed for all companies registered in India (Private Limited Company, One Person Company, Limited Company, Section 8 Company, etc.,) to provide the Shareholders, Government, Stakeholders, and the Public a broad picture of the financial affairs of the company during a financial year.

Due Date for Filing AOC-4

All companies registered in India under the Companies Act, 2013 or the Companies Act, 1956 are required to file a copy of financial statements, including all the documents which are required to be attached, duly adopted at the AGM of the company, within thirty days of conducting an AGM. Since One Person Company does not have an Annual General Meeting, One Person Company must file a copy of the financial statements duly adopted by its member, within 180 of the closure of the financial year.

If the AGM of a company for any year has not been held, the financial statements along with the documents required to be attached, duly signed along with the statement of facts and reasons for not holding the AGM should be filed with the Registrar within 30 days of the last date before which the AGM should have been held.

The Penalty for Late or Non-Filing of AOC-4

MCA has notified, the Companies (Registration Offices and Fees) Second Amendment Rules 2018 on 7th May 2018.

Now, the late fee for filing Annual Return under Section 92 and Annual Financial Statement under Section 137 after due is Rs. 100 per day with effect from 01st July 2018.

MCA has given an opportunity to the stakeholders to complete their pending filing by implementing the late fee with a prospective date of 1st July 2018.

Now late fee for filing Annual Return under Section 92 and Annual Financial Statement under Section 137 after the due date is as follows:

Due Date of Filing Forms Additional Fee

Expire after 30th June 2018 MGT-7, AOC-4, AOC-4 XBRL and AOC-4 CFS Rs. 100 per day after the expiry of due date

Expired on 30th June 2018 MGT-7, AOC-4, AOC-4 XBRL and AoC-4 CFS Rs. 100 per day from 01st July 2018

Already Expired before 30th June 2018 23AC, 23ACA, 23AC XBRL, 23ACA XBRL, 20B, 21A under Companies Act, 1956 and

MGT-7, AOC-4, AOC-4 XBRL and AOC-4 CFS under Companies Act, 2013

1. As per the applicable slab for the period of delay up to 30th June 2018 and

2. Rs. 100 per day from 01st July 2018

[…] Companies Act, 2013 or the Companies Act, 1956 is required to file their Financial Statements in e-Form AOC-4 including Directors Report along with other relevant attachments (Annual Report) and Annual […]