Top Mistakes People Make When Filing Their Income Tax Returns

Even a small error in your tax return can lead to delays, penalties, or missed refunds. Here’s a quick guide to the most common mistakes taxpayers make and how to avoid them with expert help.

Filing your income tax return might seem simple: gather the numbers, upload the forms, and you’re done. But the truth is, many people end up making small errors that lead to notices, delays, or missed refunds. These mistakes are more common than you think and can easily be avoided with the right guidance.

As income tax filing consultants, we’ve seen how well-intentioned taxpayers slip during the process. Whether you’re a salaried employee, a freelancer, or a business owner, it pays to know what not to do when filing your return. Let’s go through some of the most common mistakes people make and how you can avoid them.

Choosing the Wrong ITR Form

One of the biggest mistakes people make is filing their return under the wrong form. Each Income Tax Return (ITR) form serves a different purpose and using the wrong one can led to your return being rejected.

For instance, ITR-1 is meant for salaried individuals with a single property and basic investments. But if you earn from multiple sources, have capital gains, or own more than one house, you need to switch to ITR-2. Many people overlook this distinction and end up filing incorrectly.

That’s where professional income tax return consultants can help. They review your income type, verify your documents, and ensure you’re using the right form from the start, saving you both time and potential penalties.

Missing Eligible Deductions and Exemptions

You’d be surprised how often taxpayers leave money on the table by missing deductions they’re legally entitled to. Sections like 80C (for investments), 80D (for health insurance), and home loan interest are frequently overlooked during self-filing.

These deductions can significantly reduce your tax liability or even get you a refund. The problem is, when you file on your own, it’s easy to miss a document or forget a deduction you claimed last year.

Expert income tax filing services to make sure every eligible deduction is included. At Shah & Doshi, our consultants review your financial details carefully to help you claim the maximum benefits possible.

Incorrect or Incomplete Information

Another common issue is inaccurate information. A mismatch between Form 16 and the reported income, an incorrect PAN or Aadhaar number, or a bank account left unverified. Even small typos can lead to delays in refund processing or trigger an income tax notice.

Many self-filers also forget to disclose all their income sources or fail to match their TDS details with Form 26AS. These errors may not seem big but can easily raise red flags.

Working with professional income tax return filing consultants helps prevent such errors. They cross-check all your details and ensure your return is accurate and complete before it’s submitted.

Ignoring Income from Other Sources

This is one of the most frequent mistakes seen every year. People often forget to report additional income, such as savings account interest, fixed deposit interest, rental income, or freelance earnings.

What many don’t realize is that the Income Tax Department already has access to much of this information through your PAN. So, if you skip declaring any of it, your return might get flagged for scrutiny later.

With expert income tax return consultants, all your income streams are reviewed carefully. Whether it’s rental earnings or a small side gig, everything is accounted for correctly to keep your filing compliant and worry-free.

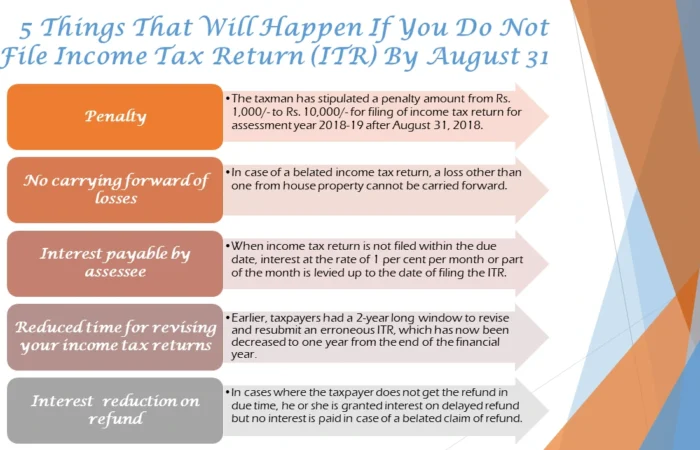

Filing Late or Forgetting to Verify Your Return

Another common mistake many people make is waiting until the last week to start filing. When you rush, you’re more likely to miss important details or make errors that could have been avoided. Filing after the due date also attracts penalties and may reduce your chances of getting a quick refund.

Even after filing, some taxpayers forget one crucial step: e-verification. If your return isn’t verified within the deadline, it’s considered invalid, which means it’s as if you never filed at all.

That’s why it helps to rely on a trusted income tax return service provider. Professionals handle every step, from preparing your return to completing e-verification, ensuring your filing is submitted correctly and on time.

Not Reporting Foreign Income or Assets

Many NRIs and resident individuals with foreign investments forget to disclose details of income or assets held abroad. Even if these assets don’t generate income, they must still be declared under Indian tax law.

Missing this information can invite serious compliance issues and scrutiny from the tax department. It’s a mistake that’s often made of confusion rather than intent.

Experienced income tax return consultants understand these complex disclosure requirements. They make sure all your global income and assets are accurately reported in your ITR, keeping you compliant with both Indian and international tax norms.

Overlooking Tax Notices or Not Seeking Professional Help

A lot of people assume their job ends once they’ve filed the return. But if the Income Tax Department sends a notice or asks for clarification, it’s important to respond correctly and on time. Ignoring these notices or replying with incomplete details can lead to unnecessary stress.

That’s why working with professional income tax filing consultants is so valuable. They not only file your return but also guide you through post-filing queries, amendments, or rectifications. Having experts on your side means you won’t have to deal with confusing tax jargon or panic about missing a notice deadline.

How Shah & Doshi Simplify the Process

At Shah & Doshi, our goal is to make your tax filing experience completely hassle-free. We’ve helped thousands of individuals, business owners, and NRIs file their returns accurately and confidently.

- Every deduction and exemption you’re entitled to is claimed.

- Your return is reviewed twice for accuracy and compliance.

- Filing and e-verification are completed within 24–48 hours.

- Post-filing support is available in case of any refund or notice-related queries.

With our income tax return services, you can focus on your work or business while we handle the paperwork, deadlines, and compliance for you.

Stay Ahead of Tax Season with Expert Guidance

Filing your taxes isn’t just a yearly formality; it’s a crucial step toward financial clarity and peace of mind. The more accurate your filing, the fewer chances of errors, delays, or penalties.

If you’ve ever felt unsure about which form to choose, what documents to attach, or how to maximize your refund, it’s time to seek professional help. At Shah & Doshi, our income tax return companies combine experience and precision to make the process effortless for you.

So, this year, skip the confusion. Let our income tax filing consultants help you file smart, file right, and stay compliant, every single time.

Contact Shah & Doshi today and experience professional tax filing that saves you time, effort, and unnecessary worry.