Meaning & Applicability Of Professional Tax In India (PTRC)

Professional Tax was introduced in the year 1949 via powers given to the States by the way of Clause (2) of Article 276 of The Constitution of India. It is levied on all the Income earned by the way of profession, trade, calling and employment. Professional Tax happens to be a source of revenue for the State Government and its collection helps them in implementing welfare schemes for the overall growth and development of the respective state.

PTEC and PTRC:

The PTEC and PTRC are different certificates that are usually required by a business entity operating in India. PTEC stands for Professional Tax Enrollment Certificate and PTRC is Professional Tax Registration Certificate. PTEC permits to pay the professional tax of the business entity (Private Ltd, Public Ltd, OPC, etc) and also of the owner or professional (sole proprietor, partner, director, etc). Whereas, the function of a PTRC is to permit the employer (government or non-government) to deduct professional tax from the employee’s salary or wages and deposit the same to the respective state government. A fully functional business entity commonly requires both to conduct its business operations.

Professional Tax (PTRC) General Tax Amount and Due Dates:

Professional tax (PTRC) is required to be deducted from the salary or wages paid. Since it is imposed at the state level, different states have different rates, collection method and hence, the tax amount varies but it is capped at Rs.2500 per annum. The rate is thus, charged on the Income Slabs set by the concerned State Governments.

Following Details are Provided for PTRC for the State of Maharashtra for FY 2017-18

Registrations:

Obtaining a PTRC registration is mandatory within 30 days of employing first staff in the business. A delay in obtaining the PTRC Certificate will be charged at Rs.5 per day from the due date.

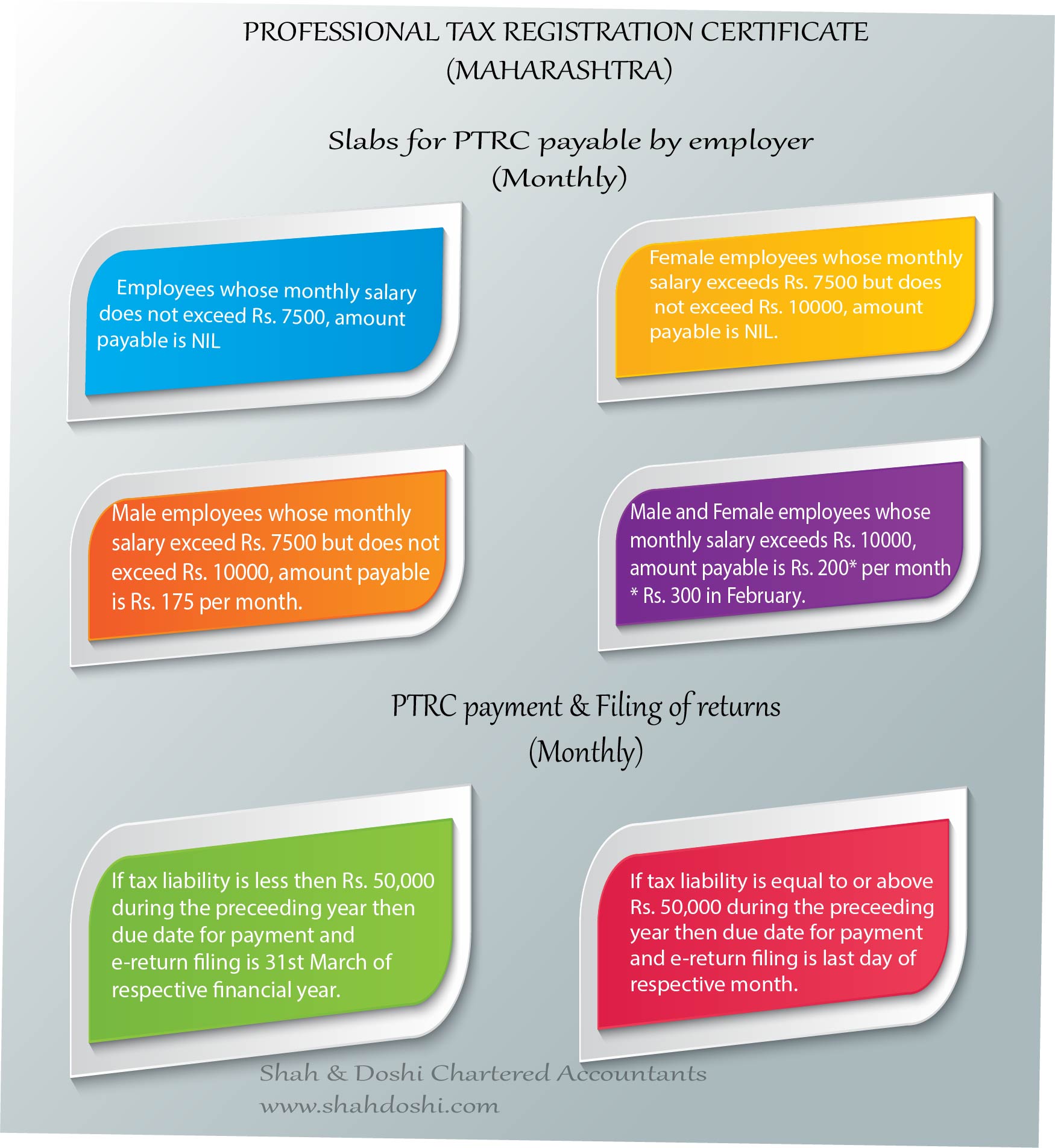

Slab for PTRC Payable by the Employer:

SALARIES OR WAGES PAID TO EMPLOYEES (MONTHLY) AMOUNT Does not exceed Rs. 7,500 NIL Female - Exceeds Rs. 7,500 but does not exceed Rs.10,000 NIL Male - Exceeds Rs. 7,500 but does not exceed Rs.10,000 Rs. 175 per month Female and Male –Exceeds Rs.10,000 Rs. 200 per month*

*Rs.300 in the month of February.

PTRC Payment and Filing of Returns:

Annual Tax Liability During the Preceding Year Periodicity Due Date for Payment & E-Return Filing Annual Tax Liability less than Rs. 50,000 Annually* 31st March of the respective F.Y. Annual Tax Liability equal to or above Rs. 50,000 Monthly Last day of the respective month.

*Periodicity is monthly in the first year of registration.

Interest Rates:

An interest of 1.25% pm shall be levied on delayed payments of PTEC.

Nicely explained Soumya!!!. Keep it up.

I am a proprietor of XYZ consulting business. As a Individual I pay annual Profession tax of Rs. 2500/- . I am also Karta of my HUF firm which is almost a propitiatory kind firm. Am i suppose to pay annual professional tax of rs.2500/- again for HUF. Please note Individuals are same. Kindly advice as there is no clarity about this professional tax rule in Maharashtra

For each pan there would be one PTEC. For each Pan that has employees there would be one PTRC! So since HUF has its own pan it would have its own PTEC and if they have employees it would have their own PTRC!

Is there any requirement of minimum employees for getting PTRC??

Please send reply, number of emplyees required for Profession Tax.