GST Return Filing Late Fees: What You Need to Know

In India, the Goods and Services Tax (GST) is an indirect tax on various goods and services supply. After successfully registering on the GST portal, taxpayers who have been officially registered must submit periodic documents known as GST returns online. This statement of detailed information mentions a particular company’s business activities and tax obligations. One must note that GST returns late fees exist if GST returns are not offered for submission by the given deadline.

The following blog explores GST return last dates, late fees, and penalties for overdue GST return filings.

Meaning of GST Return Late Fee

A delay in GST return filing comes with a price. This price, also known as the payment, required by GST regulations, is called the GST return late fee.

A registered taxpayer might miss the deadline for filing GST returns, for which a statutory GST late fee is charged for each passing day of the delay. In addition to this late fee, an interest of 18% will be levied. The payment must be made in cash, whereas the Input Tax Credit (if available in the electronic credit ledger) would not be considered for use.

GST return filing consultants mention that the frequent inability to submit zero returns promptly will result in a late fee. For instance, even with sales made by the company, a late fee must be paid. Here, the “no GST” concept must be recorded in the GSTR-3B form. A violation of the law will be regarded when a failure to submit the GST return by the deadline by the concerned department is found, besides being charged with a subject to a severe fine. However, the late fee amount might vary depending on the kind of GST return filing.

The three groups comprise –

- GST non-annual returns late fee

- Annual GST return late fee

- Late filing penalties for NIL returns

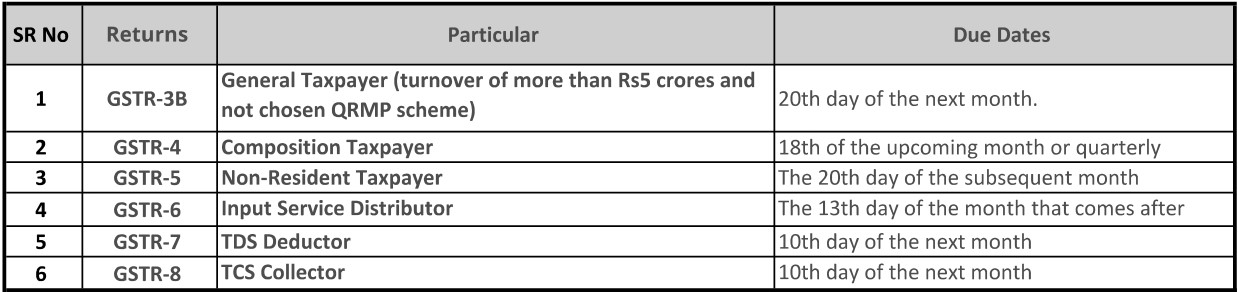

Besides this, one must also know that late fees are only charged under GSTR-3B, GSTR-4, GSTR-5, GSTR-5A, GSTR-6, GSTR-8, GSTR-7, and GSTR-9.

Meaning of GST Return Last Date

Various dates are declared for GST payments to be made by a variety of taxpayers. Some of these due dates of taxpayers are:

GST Return Late Fees: Calculation

The calculation of late fees and penalties for overdue GST return filings differs in different forms. Read the detailed statement below to understand the calculations for late payments of GST:

GSTR – 3B Late Fee

Rs 20 (Rs 10 for CGST and Rs 10 for SGST) is charged daily for zero GST returns. In all other circumstances, a Rs 50 fee (Rs 25 for CGST and Rs 25 for SGST) must be paid. This case can go up to Rs 10,000.

GSTR – 9A and GSTR – 9 Late Fee

The fee for late payments of GSTR—9 and GSTR—9A is Rs 200 per day. This includes Rs 100 for CGST charges and Rs 100 for SGST charges. The fee can only be 0.50% of the combined yearly turnover.

GSTR – 10 Late Fee

For late payments, GSTR-10 forms charge Rs 200 (Rs 100 each for CGST and SGST). No upper limit is attached to it.

Interest Charged on Late GST Return Filings

The regulation for the GST returns late fee instructs taxpayers that failing to meet the deadlines for paying taxes on time should be charged an annual GST interest rate of 18%. The following interest will be calculated after the passing of each day after the due date of the GST return filing.

A sum of Rs 50 will be charged as a late fee per day (Rs 25 charged for CGST and Rs 25 charged for SGST) for any tax liability and Rs 20 per day (Rs 10 charged for CGST and Rs 10 charged for SGST) if zero tax liability is subjected to a cap of Rs 5,000. If a taxpayer fails to submit a GST return filing by the deadline, this amount must be deducted from the given amount.

- When the payment of GST is delayed: 18%

- When there is excess or undue tax liability reduction: 24%

- When there is an excess or undue ITC claim: 24%

GST Rules Regarding GST Payments

To pay GST forms, a challan valid for only 15 days (about 2 weeks) must be used. Once the payment process is successfully completed, the taxpayer will receive a Challan Identification Number.

Offline payment is only applicable to challans charged at Rs 10,000. Instruments like cash payments, cheques, or demand drafts are valid for paying them. For GST return filing, interest, and late fees, challans exceeding Rs 10,000 can be paid online.

The taxpayer’s electronic cash ledger is credited when online transactions for tax, GST interests, GST return late fees, or late fees are paid using RTGS, NEFT, Internet banking, and credit cards. Any pending amount will be used to pay pending dues, fees, debts, or unpaid interest.

Preparing oneself for all the required paperwork, documents, and exemptions as specified is essential. New statutes have led to several adjustments, and, in certain cases, interest is levied on the incurrence of GST return late fees. Therefore, businesses charging GST must also submit their returns on time to the tax department’s requirements. Missing essential dates might result in late fees for GST returns.

Shah and Doshi is a trusted business consultancy in Mumbai that offers GST return filing and a wide range of services. Our team of professionals ensures accurate, timely submissions and personalized solutions, minimizing errors and penalties. We provide proficient Audit and Tax Consultancy services, supported by Chartered Accountants, Company Secretaries, Cost Accountants, System Auditors, and Management Graduates. In addition to GST return filing, we offer incorporation, registration, tax compliance, audit services, and more tailored to meet individual business needs.