Everything About Reverse Charge Mechanism Under GST!

Usually, the supplier pays tax on supply. But in this case, the receiver or recipient becomes liable to pay tax which means the chargeability gets reversed & hence, it is known as the Reverse Charge Mechanism.

In simple words, it means the liability to pay tax is on the recipient of goods or services instead of the supplier. The concept of Reverse Charge Mechanism is applicable to both goods & services.

1.REGISTRATION:

Every person who is required to pay Tax under the Reverse Charge Mechanism has to register himself under the GST regime, irrespective of the GST threshold limit of turnover in a financial year should be more than Rs 20 lakhs & Rs 10lakhs for North Eastern states.

2.CASES WHERE REVERSE CHARGE WILL APPLY:

- THE LIST OF GOODS & SERVICES APPLICABLE UNDER THE REVERSE CHARGE MECHANISM ISSUED BY THE CBEC.

- UNREGISTERED DEALER SELLING TO A REGISTERED DEALER

In case of supply by an unregistered dealer to a registered dealer where supply is of taxable goods or services, the registered dealer has to pay GST on the supply.

- SERVICES THROUGH AN E-COMMERCE OPERATOR

If E-commerce operator is supplying services then the reverse charge will apply to the e-commerce operator; he is thus liable to pay GST.

In case the e-commerce operator does not have a physical presence in the taxable territory, then a person representing such electronic commerce operator for any purpose will be liable to pay the tax. If there is no representative, then the operator must appoint a representative who will be then held liable to pay GST.

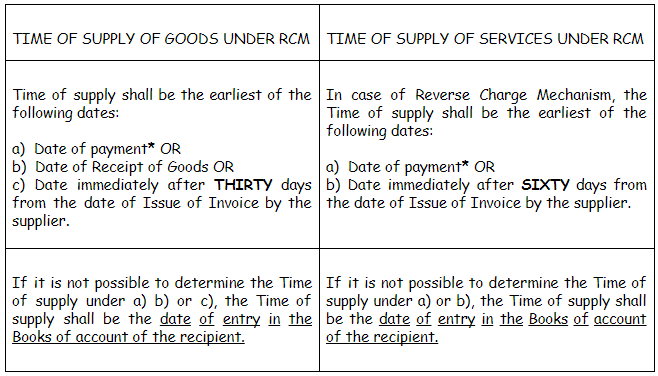

3.DETERMINATION OF TIME OF SUPPLY IN CASE OF GOODS & SERVICES:

*For clause (a) – the date of payment shall be EARLIER of-

1. The date on which the recipient entered the payment in his books.

OR

2. The date on which payment is debited from his bank account.

WHEN THE SUPPLIER OF SERVICES IS LOCATED OUTSIDE INDIA:

In the case of ‘associated enterprises’, where the supplier of service is located outside India, then the Time of supply shall be the EARLIEST OF

Date of entry in the books of account of the receiver

OR

Date of payment.

Example:

XYZ Ltd. in India has set up a subsidiary Company in Dubai. The subsidiary company provides services to XYZ Ltd. for which XYZ paid 1,000 Dirham (currency of Dubai) on 2nd July 2017. It was recorded on 5th July 2017. XYZ Ltd. will pay the reverse charge as the subsidiary company is located outside India.

Time of supply will be 2nd July 2017.

4.TAX INVOICE:

The supplier must mention in his tax invoice whether Tax is payable on reverse charge. The recipient needs to generate & Issue an Invoice.

5.TREATMENT OF REVERSE CHARGE UNDER GST:

- FOR SERVICES:

The following example explains the scenario for present reverse charge provisions under service Tax, i.e. applicable on certain services.

-Hola chef is an online platform that provides food prepared by its chefs & delivers to its customers for a gourmet experience. The chefs provide their culinary skills & cooking services to Holachef; here Holachef becomes the service receiver and pays its chef a share of the total amount collected from its customers.

Holachef thus pays GST on the Chef’s cooking services on the Reverse Charge basis. This eventually becomes Cost to Holachef which it later recovers from its customers.

The concept of Reverse Charge Mechanism strives to eradicate the burden of tax compliances from Individuals having limited resources to large companies having a huge amount of resources, also aiming to bring the unorganized sector into the Tax umbrella.

- FOR GOODS:

For the first time under GST, the reverse charge is applicable to goods.

The GST Compensation cess will be applicable on reverse charge mechanism. GST Compensation cess will be levied and collected at a rate, which will be notified later. This cess will apply to all the supplies of goods and services including imports and reverse charge supplies.

The purpose is to compensate States for the loss of revenue on the implementation of GST. This will be applicable for 5 years from the date GST gets implemented.

6.INPUT TAX CREDIT ON REVERSE CHARGE:

- The service recipient can avail Input Tax credit on the Tax amount that is paid under reverse charge on goods and services, the only condition to be followed is that the goods and services are used or will be used for business or furtherance of business.

- ITC cannot be used to pay output tax under reverse charge mechanism i.e. the payment mode is only through cash.

7. BELOW ARE THE LISTS OF EXCEPTIONS & INCLUSIONS OF RCM UNDER THE GST REGIME:

Exceptions of RCM:

- Salary

- Electricity

- Interest

- Car Fuel

- Government fees

Inclusions:

- Rent

- Commission payments

- Printing & stationery

- Repairs & Maintenance

- Office Maintenance

- Vehicle Maintenance

- Computer Maintenance

- Legal Fees

- Consultancy Fees

- Professional Fees

- Audit Fees

- Labour Charges

- Freight & Transportation expenses

- Gift expenses

- Business promotion expenses

- Advertisement,etc.

8.NOTIFICATION:

In exercise of the powers conferred by section 11(1) of the Central Goods and Services Tax Act, 2017, on the recommendations of the Council, hereby EXEMPTS INTRA-STATE supplies of goods or services or both received by a registered person from any supplier, who is not registered, from the whole of the central tax leviable thereon under section 9(4) of the CGST ACT, Provided that the said exemption shall not be applicable where the aggregate value of such supplies of goods or service or both received by a registered person from any or all the suppliers, who is or not registered, EXCEEDS FIVE THOUSAND RUPEES IN A DAY.

This notification shall come into force with effect from the 1st day of July 2017.