DIR 3 KYC and DIR 3 KYC WEB

What is DIN and DIR 3?

A unique Director Identification Number (DIN) can be obtained by any individual willing to become a director or partner in one or more companies to be registered with The Ministry of Corporate Affairs (MCA). Getting a DIN is a one-time process which can be completed by making an application in the E-form DIR 3.

What is DIR 3 KYC and DIR 3 KYC WEB?

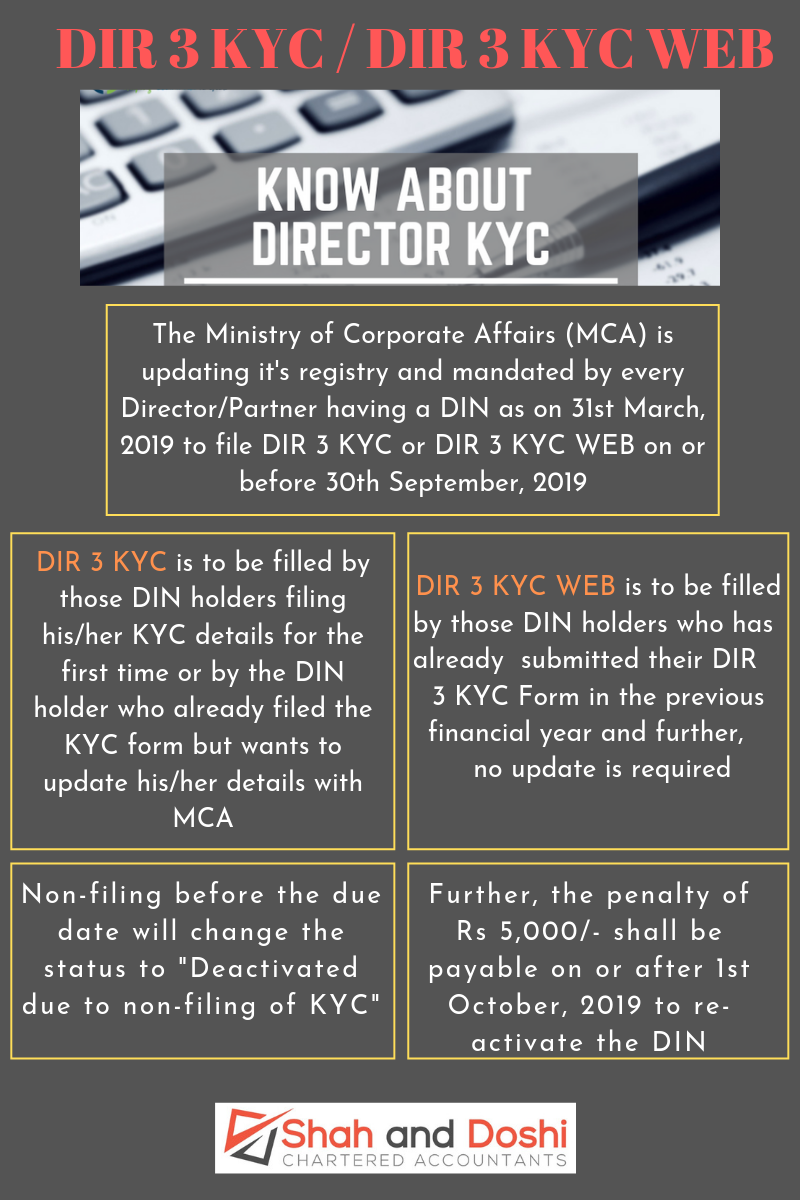

MCA is updating its registry and requires all the DIN holders to submit or update their KYC annually.

As per its recent announcement, all the directors or partners who have been allotted a DIN on or before the 31st March 2019, are required to submit or update their KYC details either through DIR 3 KYC or DIR 3 KYC WEB. It is to be noted that filing this E-form is mandatory for all directors and partners, including disqualified directors/partners. The due date of filing this form is 30th September 2019.

DIR 3 KYC is to be filed by those DIN holders filing his/her KYC details for the first time or by the DIN holders who has already filed his/her KYC form but wants to update his/her details with the MCA.

DIR 3-KYC WEB is to be filled by those DIN holders who have submitted their DIR 3 KYC Form in the previous financial year and further, no update is required.

Every director is required to file the E-form on the MCA portal. If a director fails to file the DIR 3 KYC Form or DIR 3 KYC WEB before the due date, then his/her DIN will be de-activated.

What Is Government Penalty for Non-filing of DIR 3 KYC?

For the current financial year (2019-2020), no filing fees shall be chargeable by ROC till 30th September 2019 and a penalty of Rs. 5,000/- shall be payable on or after 1st October 2019 to re-activate the DIN.

What are the Documents required for filing DIR 3 KYC?

>> For Indian Nationals having DIN:

- PAN Card Copy

- Aadhar card / Driving License Copy

- Passport Copy, if available

- Kindly confirm whether Present / Permanent address is same

- Incase if Present Address is different, then provide the documents as mentioned in Pt.3 for Present address ALSO

- Personal Mobile Number of Director.

- Personal Email ID of Director.

- Valid PAN-based DIGITAL SIGNATURE with a password of the Director

>>For Foreign Nationals having DIN:

1. Apostilled / Consularized and Notarized Passport.

2. Apostilled / Consularized and Notarized: (any one of the below).

a. Electricity Bill (Should not be older than 2 months).

b. Telephone Bill (Should not be older than 2 months).

c. Mobile Bill (Should not be older than 2 months).

d. Bank Statement (Should not be older than 2 months).

e. Valid DIGITAL SIGNATURE with a password of the Director.