Everything About Compensation Cess Under GST

MEANING OF GST COMPENSATION CESS:

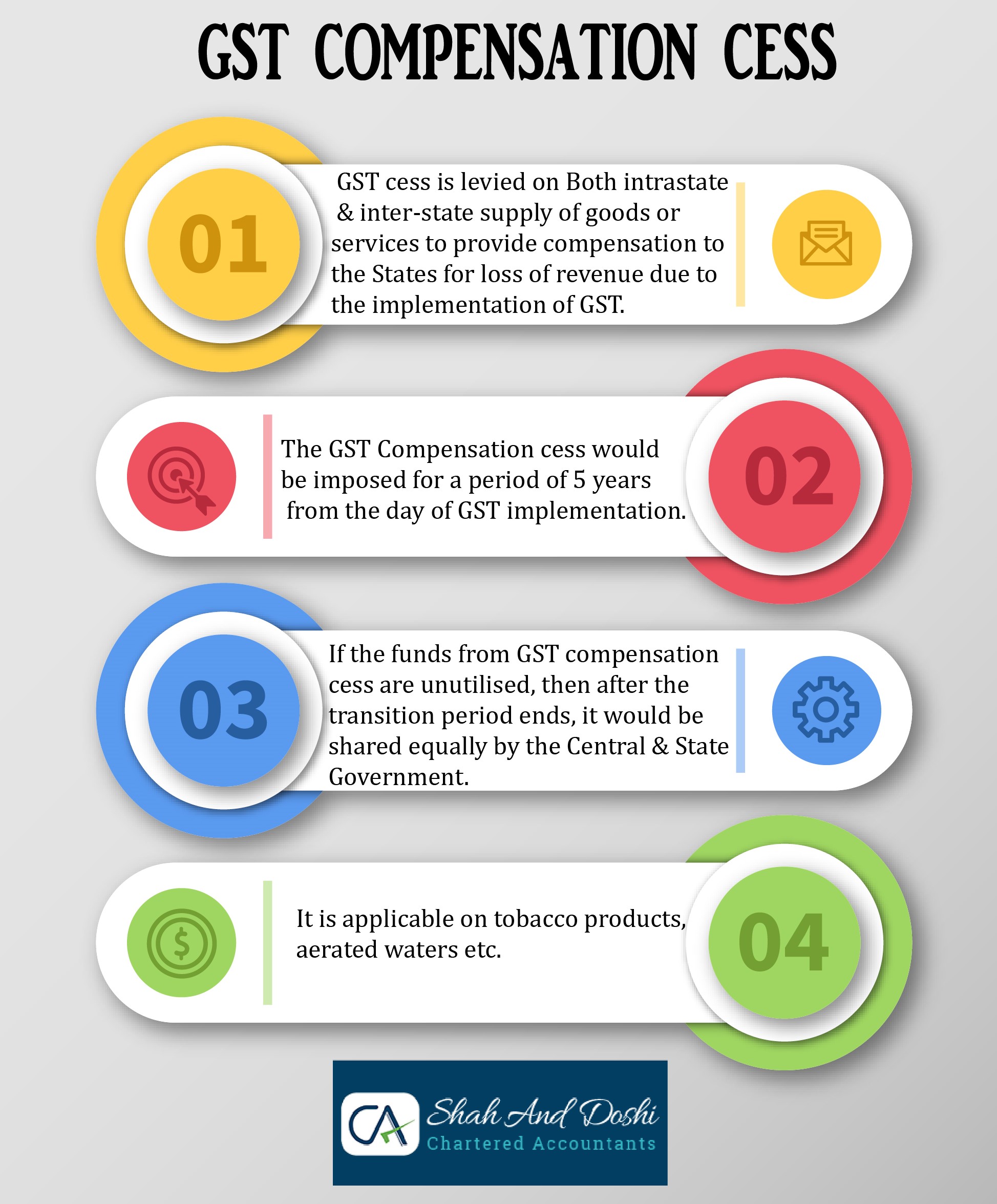

The GST Compensation cess is levied under section 8 GST (Compensation to state) act, 2017. It would be imposed for a period of 5 years from GST implementation.

GST cess is levied on the intra-state supply of goods or services & inter-state supply of goods or services to provide compensation to the States for loss of revenue due to the implementation of GST in India. It would attract GST cess over and above the applicable CGST, SGST, and IGST rates.

In this article, we will see the applicability of GST Cess & rate of GST cess on certain goods.

WHY IS GST CESS IMPOSED?

GST cess is imposed to compensate for the State’s loss of revenue due to the implementation of GST. If the funds from GST compensation cess are unutilised, then after the transition period ends, it would be shared equally by the Central & State Government.

The State Government’s share will be distributed in the ratio of their total revenues from State Tax on the goods and services in the last year of the transition period.

APPLICABILITY OF CESS:

GST cess will be applicable to both suppliers of goods and services. All taxpayers under GST except taxpayers registered under GST composition scheme are required to collect and remit GST cess.

GST COMPENSATION CESS IS APPLICABLE ON THE FOLLOWING GOODS:

AERATED WATERS – 12%

(also Lemonade & others, containing added sugar or other sweetening matter or Flavoured).

PAN MASALA – 60%

TOBACCO & TOBACCO PRODUCTS – Different rates are fixed for different products, reaching up to 204% of GST cess on certain products like Pan Masala containing ‘Gutka’.

Hi Soumya,

Thanks for sharing blog on compensation cess under GST. This blog is well written & informative blog. It would more readable if there were some stuff like charges on products like electronics, furniture products etc.