All You Need To Know About Advance Tax Payment

What is an Advance Tax Payment?

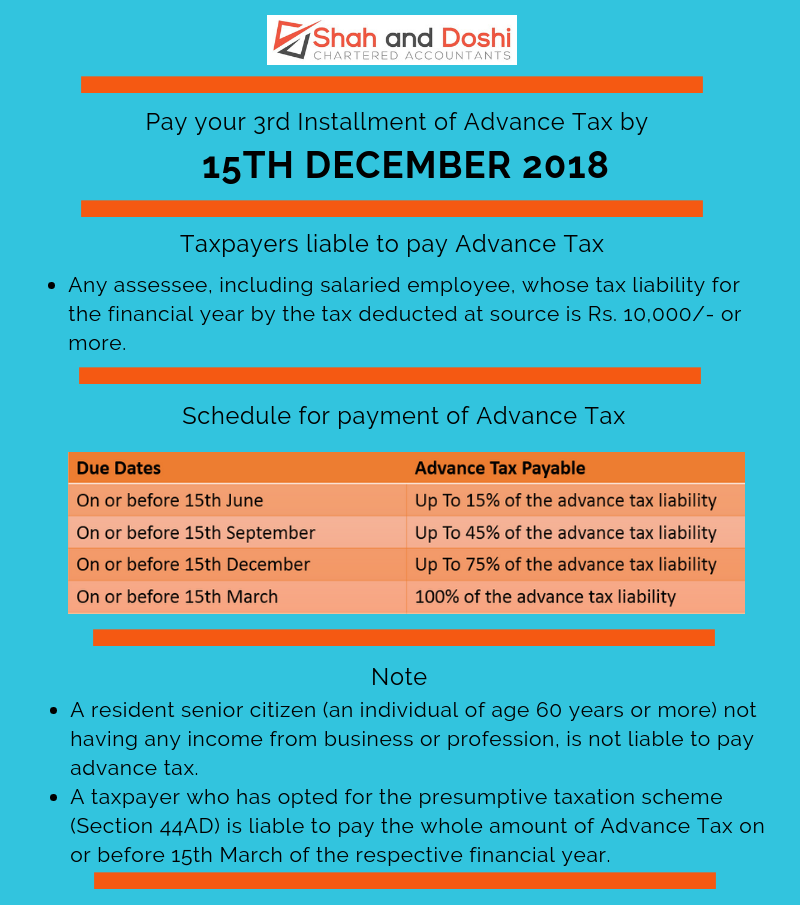

In a financial year, if the Income Tax Liability of any taxpayer is more than Rs. 10, 000, then he is liable to pay such tax in installments during the year itself rather than paying this tax at the end of the year. This tax which is payable during the year is called Advance Tax Payment or “pay as you earn tax” as the tax is liable to pay at the time income is earned i.e. during the year itself rather than paying this tax at the end of the year.

Who should pay Advance Tax?

As the employer usually deducts tax at source (TDS), salaried persons are not required to pay advance tax. However, if an employee has any other income other than salary income for which tax has not been deducted at source and the tax liability exceeds more than Rs.10000, then advance tax must be paid.

Professionals (self-employed), businessmen and corporates typically have taxable income that exceeds the advance tax payment threshold; they will have to pay taxes in advance.

Advance Tax Exemption

A resident senior citizen (an individual of age 60 years or more) who do not have any income from business or profession, according to Section 207 of the Act, is not liable to pay advance tax. For example, a senior citizen may have various sources of income such as rental income, pension, interest from bank deposits, or dividends. As these sources of income do not fall under the income tax head of “income from business or profession” senior citizens do not have to pay advance tax. Also, this exemption is provided to a senior citizen irrespective of the amount of income that he/she earns from a source other than business or profession.

When to pay Advance Tax?

For both Corporate & Non-Corporate Assessee

| Due Dates | Advance Tax Payable |

| On or before 15th June | Up To 15% of the advance tax liability |

| On or before 15th September | Up To 45% of the advance tax liability |

| On or before 15th December | Up To 75% of the advance tax liability |

| On or before 15th March | 100% of the advance tax liability |

Taxpayers who opted for the presumptive taxation scheme (Section 44AD)

| Due Date | Advance Tax Payable |

| On or before 15th March | Up to 100% of advance tax |

The Penalty for Default in Advance Tax Payment

Under Section 234B of the Income Tax Act, the penalty is applicable if:

- A taxpayer has failed to pay advance tax even though he is liable to pay advance tax; or

- The advance tax paid by the taxpayer is less than 90% of the assessed tax.

Interest for default in the payment of advance tax, under Section 234B, is levied at 1% simple interest per month or part of a month. The penalty interest is levied on the amount of unpaid advance tax. If there is a shortfall in payment of advance tax, then interest is levied on the amount by which advance tax is short paid.

The Penalty for Short Payment of Advance Tax Payment

Under Section 234C, Penal interest is levied only if:

- Advance tax paid on or before 15th June is less than 12% of advance tax payable.

- Advance tax paid on or before 15th September is less than 36% of advance tax payable.

- Advance tax paid on or before 15th December is less than 75% of advance tax payable.

- Advance tax paid on or before 15th March is less than 100% of advance tax payable.

For taxpayers enrolled under the presumptive taxation scheme, the penalty under Section 234C will be levied only if advance tax paid on or before 15th March is less than 100% of advance tax payable.

Penal interest would be payable on the amount of advance tax short paid at the rate of 1% simple interest per month. Interest under section 234C is levied for a period of 3 months, in case of shortfall in payment of 1st, 2nd, and 3rd installment and for 1 month, in case of shortfall in payment of the last installment.