Understanding GST Return Filing: A Comprehensive Guide

Goods and Services Tax, commonly known as GST, is implemented in India as an indirect tax procedure to replace multiple indirect taxes levied by the state and central governments. GST return filing is vital to complying with the GST regulations. The following blog presents a comprehensive overview of GST return filing in India.

What is a GST Return?

A GST return is a document that includes a taxpayer’s income, payments, and tax liability made during a particular period. It reports the registered taxpayer’s GST transactions to the tax authorities.

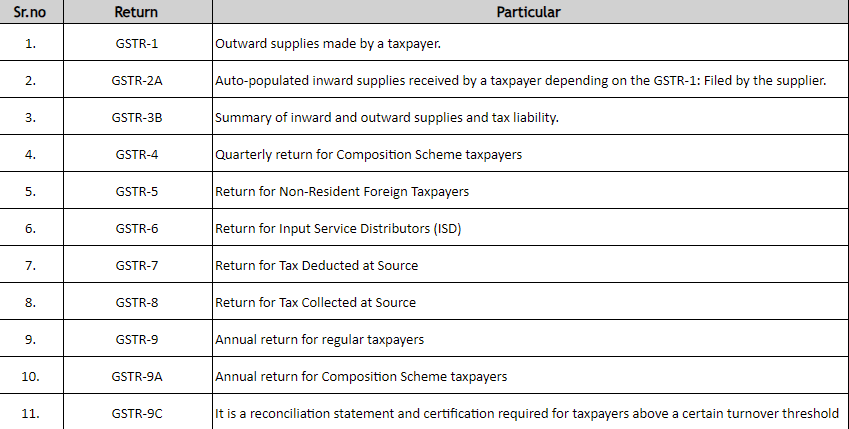

Types of GST Return Filings:

Various kinds of GST return filings are available based on the type of taxpayer and their activities. Here are the most common ones along with their due dates:

GST Return Filing Process

The GST return filing process in India comprises the following steps:

- Obtain GST Registration: Before GST return filing, the taxpayer must obtain GST registration by submitting an online application on the GST portal (www.gst.gov.in). The taxpayer must provide the necessary documents and information per the registration requirements.

- Choose the Correct GST Return Form: Various GST return forms are available, depending on the type of taxpayer and the nature of transactions. The typical ones for regular taxpayers are GSTR-1, GSTR-3B, and GSTR-9/9C.

One must select the appropriate form for filing. - Maintain Records: Maintain accurate records of all sales, purchases, input tax credits and other relevant transactions if you are a registered taxpayer. These records will help you prepare your GST returns.

- Determine GST Return Due Date: The due dates of the returns are determined by the kind of turnover and the taxpayer. By the 11th of the following month, regular taxpayers file for GSTR-1, with GSTR-3B by the 20th/22nd of the following month and GSTR-9/9C by December 31st of the subsequent financial year.

- Calculate Output Tax Liability: GSTR-1 requires you to provide details of your outward supplies (sales) and the applicable tax rates during the return period. To calculate the output tax liability, multiply the taxable value of your sales by the respective GST rates.

- Determine Input Tax Credit: The tax you have paid on your purchases is the input tax credit that can be offset against your output tax liability. Calculate the input tax credit by adding the GST paid on eligible purchases during the return period for GSTR-3B.

- Fill Out the GST Return Form: Fill in the required information using the designated GST return form on the portal. Provide details on inward (purchases) and outward supplies, input tax credits, and other important information.

- Validate and Verify Data: Before you send in your GST return, check the data for mistakes or things that must match up. The GST portal has a validation mechanism that makes this easy.

- Pay Tax and File the Return: Pay online or offline if you owe any taxes after accounting for input tax credits. Then, submit your return electronically on the GST portal.

- Generate ARN or Acknowledgment: After you submit, you’ll get an Acknowledgment Reference Number (ARN) to show you the filing. Remember to keep this number for later.

- Reconciliation and Rectification: Check your GST returns against your accounting records often. If you find mistakes, fix them by completing the correct form to change your original return.

Note: The GST return filing process and forms may change and may experience updates by the Indian government. Refer to the official GST portal and contact GST return filing consultants to file your GST return smoothly.

GST Return Due Dates:

Relying on the return type and the taxpayer’s turnover, GST return filing due dates vary accordingly. The due dates are subject to periodic changes as the government specifies them. Avoid penalties or late fees by staying updated with the upcoming dates.

Late Fees and Penalties:

Penalties and late fees are incurred due to the late filing of GST returns. If you file your taxes late, you usually must pay a set fee for each day you’re late, up to a certain maximum amount. You might also have to pay interest on any money you owe in taxes you still need to pay.

Importance of GST Return Filing:

Under the GST rules, filing your GST return is vital. It lets the government track taxes collected, ensure businesses use tax credits correctly, and stop tax dodging. Filing your GST return on time and correctly helps companies get tax credits and keep good records for following the rules.

Assistance and Resources:

The primary platform for GST return filing is operated by the Goods and Services Tax Network. Taxpayers understand and navigate the GST return filing process through the portal’s user manuals, GAQs, and other resources. Professional GST return filing consultants and accounting firms can offer further assistance.

Remember, the rules and process for filing GST returns can change. Check the official GST website and talk to experts for the latest advice tailored to your business.

With Shah and Doshi as your GST return filing consultants, unfold a guide to understand the process efficiently and accurately. Contact them for assistance today.

FAQ's

GST returns must be submitted by all companies that are registered under the Goods and Services Tax (GST) system. Businesses who provide services, make interstate supplies, or have annual turnovers higher than the exemption threshold are subject to this rule. All registered entities must file a GST return, even if no business activity took place during the tax period. Consulting with GST return filing consultants can aid in ensuring accuracy.

Companies having yearly sales over ₹5 crore are required to file monthly returns; companies with less than that amount can file quarterly reports. Businesses that have an annual revenue of less than ₹1.5 crore may also choose to file quarterly GST return filings under the Composition Scheme. It’s important to adhere to the specified timelines to avoid penalties.

Yes, registered people can revise their GST returns within the specified time frame. Changes to monthly returns can be made until the due date for filing the subsequent month’s return. Corrections to quarterly returns may be made until the due date for filing the subsequent quarter’s return. Consulting with GST return filing consultants can help identify any errors and guide the revision process.

Late filing of GST returns can attract penalties. The penalty for late filing of GSTR-1 (outward supply return) is ₹100 per day for each day of delay, subject to a maximum of 0.25% of the total turnover in the state or UT. For GSTR-3B (summary return), the penalty is ₹50 per day for each day of delay, subject to a maximum of ₹10,000. Seeking guidance from GST return filing consultants can help avoid these penalties.

To file GST returns, businesses need to have the following documents ready: invoices for inward and outward supplies, debit and credit notes, import and export documents, and bank statements. Additionally, businesses should maintain records of input tax credit (ITC) claimed, tax payments made, and any other relevant documents. Consulting with GST return filing consultants can help ensure that all necessary documents are in order.

Yes, there are certain exemptions for GST return filing. Businesses with an annual turnover below the exemption limit (currently ₹40 lakh for most states and ₹20 lakh for special category states) are not required to register under GST and, consequently, are not required to file GST returns. Additionally, certain goods and services are exempt from GST, and businesses dealing solely in these items may not need to file returns. Seeking guidance from GST return filing consultants can help determine if a business qualifies for any exemptions.